To invest or trade in the share market, an investor must know about many things. If you do trading in the stock market or know about it, you have heard many important words, one of the important words is ‘LTP’. It is important for a trader to know this information, because it helps in estimating the current position and price of any share in the market.

In this detailed article we’ll explore what is LTP in share market, why it matters in trading, how it operates, and how you may take advantage of it in the stock market. Let’s dive deep into the nuances of LTP, explaining its significance, usage, and impact on trading decisions.

Ι What Is LTP In Share Market?

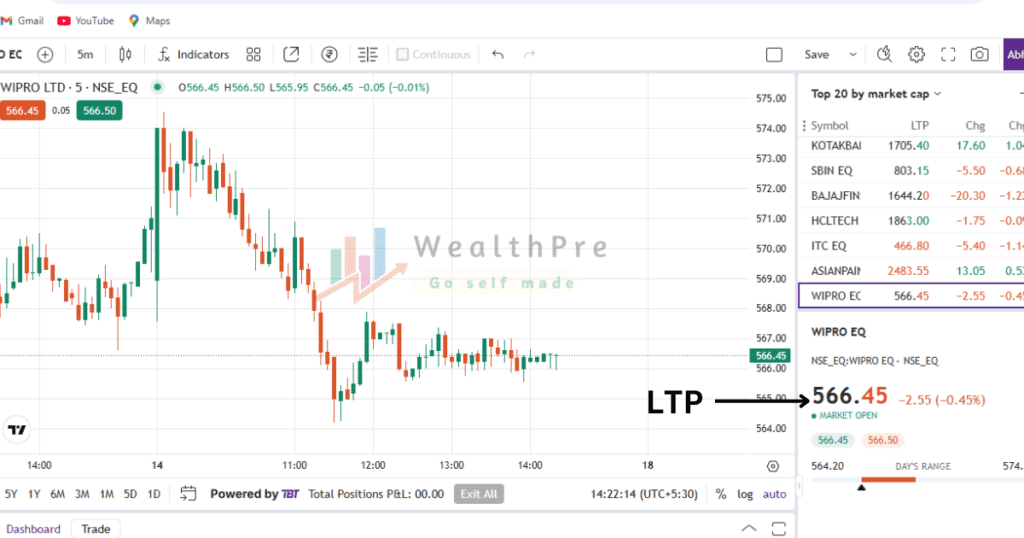

The LTP meaning is ‘Last Traded Price’. Whenever a share or option is bought or sold, the price at which the share was last traded at the time of purchase or sale is called LTP. Due to continuous trading of shares, LTP keeps changing every second.

LTP does not mean the current price of a share, but it is the price of the most recent transaction of that share. Based on this, investors and traders take decisions related to their investments. LTP is a particularly important signal because it indicates the demand and supply of shares in real time. It is very easy to see LTP in the stock market. It keeps appearing on every platform.

Essential Components of LTP:

- Dynamic and Real-Time: LTP changes every time a transaction occurs in the market. It could be different from the stock’s opening price, closing price, or even the current bid or ask price.

- Most Recent Transaction: It reflects the most recent price at which a buyer and seller agreed to exchange shares.

- Relevant Across : LTP applies not only to stocks but also to commodities, bonds, cryptocurrencies, and other financial assets traded in public markets.

Ι How To See LTP In Share Market ?

Nowadays, many types of trading platforms are available in the share market, like Upstox, Zerodha, Groww, Dhan, etc. You can see LTP In share market very easily on all these platforms. For this you just have to follow the steps given below.

- Login in to your trading app or website

- Go to the search box and select the share or index whose LTP you want to see

Ι The Role of LTP in Stock Market

LTP serves as an important reference point for both buyers and sellers in the stock market. Here’s why:

1. For Buyers:

LTP in share market plays a very important role for the buyers, it gives them the real indication of the current market situation and the current price of the share, which helps them a lot in understanding the market. At the same time, it gives information to the buyers about the right time to buy and the market trend. One of the main functions of LTP is that it helps in determining the right price for the buyers.

2. For Sellers:

LTP is also important for sellers in the stock market. It provides information to sellers about the price at which a share has recently been traded. This information helps the sellers a lot, it gives them an idea at what price they should sell the shares. When the LTP of a share is falling, it is a sign of reduced demand, which gives sellers an opportunity to sell their shares at a higher price. And whenever LTP falls, sellers feel that further decline is possible, hence they sell the shares quickly.

3. For Traders:

In the stock market, LTP gives traders the real and accurate indication of the current price of a share or an option. Especially intraday traders, LTP is used to know in which direction the share price is moving and what is its supply and demand situation. Traders can make their trading decisions quickly in rapidly changing markets with the help of LTP.

4. For Long-Term Investors:

While long-term investors focus more on fundamentals like earnings, growth potential, and market conditions, they also keep an eye on LTP to understand market trends and the sentiment around their holdings.

Ι The Significance of LTP In Share Market

LTP is more than just a number; it holds immense importance for traders, investors, and market participants alike. Here’s why it’s so significant:

1. Market Sentiment Indicator:

LTP provides insight into the market sentiment for a particular stock. If the LTP is rising steadily, it suggests that the stock is in demand and traders are willing to pay more. Conversely, if the LTP is declining, it indicates that there’s more selling pressure and traders may be losing confidence.

2. Basis for Immediate Decision-Making:

For day traders and short-term investors, LTP is crucial in decision-making. Traders use LTP to track price trends and make split-second decisions about whether to buy or sell.

3. Real-Time Value:

LTP provides the most recent, real-time valuation of a stock. This is particularly important in volatile markets, where prices can change rapidly in response to news or events.

4. Impact on Portfolio Valuation:

For investors, especially those who manage large portfolios, LTP helps in valuing their holdings. It allows them to know the real-time value of their stocks and track the market performance of their portfolio.

5. Helps Set Trade Orders:

Investors can use the LTP to set different types of trade orders like limit orders or stop-loss orders. For instance, if an investor wants to buy a stock only when it reaches a certain price, they can set a limit order based on the LTP.

Ι Difference Between LTP And Closing Price

Till now we have to know what is LTP in share market, how does it reduce and what is its importance? Now let’s know what is difference between LTP and Closing price.

The chart that has given below shows the difference between the LTP and the closing price.

| Feature | LTP (Last Traded Price) | Closing Price |

|---|---|---|

| Full Form | Last Traded Price | Closing Price |

| Meaning | The price at which the last trade of a stock occurred | The final price of a stock at market close |

| Update Frequency | Continuously changes with each trade | Updated once daily, at market close |

| Influence | Changes based on real-time demand and supply | Reflects the stock’s final price for the trading day |

| Impact on Decisions | Helps investors make decisions during trading hours | Useful for preparing strategies for the next trading day |

| Use | To know the current price of a stock in real time | Indicates the overall position of the stock for the day |

| Source | Updates instantly with every transaction | Determined at the end of the last trade of the day |

| Utility | More useful for day traders and short-term trading | More relevant for long-term investors |

Ι How Is LTP Calculated?

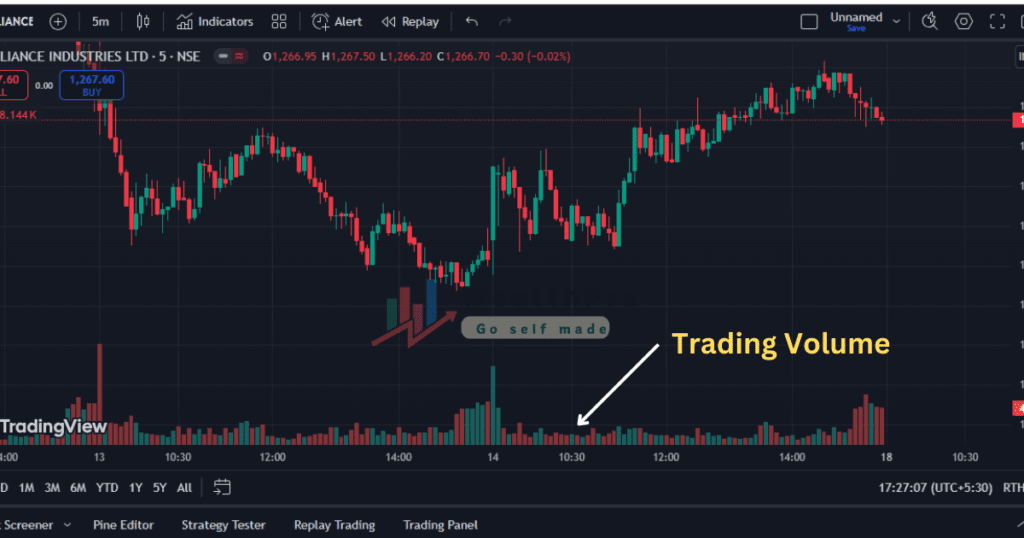

LTP is calculated in real time and varies every second during the trading day. Every time there is a transaction, the price is altered. Several variables, including market liquidity, supply and demand, affect the LTP.

The latest traded price is largely determined by the share trading volume. The trading volume indicates how many trades were made during a given time frame. A greater trading volume indicates that there are more purchasers purchasing shares and that the stock is very liquid. On the other hand, a low trade volume indicates a rise in the number of sellers. The stock’s trading volume has and impact on price fluctuations. Additionally, trade volume is a crucial consideration while engaging in short-term market trading.

Ι Conclusion: LTP In Share Market

LTP in share market, is a powerful tool in stock trading and investing, offering real-time data that reflects the most recent market activity. By monitoring LTP, setting strategic stop-losses, and comparing it with other indicators, you can make better, more informed decisions in the stock market. However, remember that LTP should be part of a broader strategy that includes fundamental and technical analysis for optimal results.

i hope that form the above information you will know what is LTP is share market. to get such valuable information related to trading and share market, subscribe to our blog wealthre.

Ι Frequently Asked Questions (FAQ’s)

What is LTP in the stock market?

LTP which is stands for (Last Traded Price) is the price at which an asset or stock was last traded. it displays the market value as of the most recent transaction.

what is the full form of LTP?

The full form of LTP is (Last Traded Price)

Why does LTP change frequently?

LTP changes with every transaction in the stock market. When a buyer and seller agree on a price and a trade is executed, that price becomes the new LTP. As trades happen throughout the day, LTP keeps fluctuating.