Any investor in the share market, whether he is trading or investing, his main goal is to save his money and make more money as quickly as possible. For this, traders use many strategies. One of their popular strategies is BTST (Buy Today Sell Tomorrow). This is one such strategy which gives very fast profits. This strategy is in great demand for those people who have a correct estimate of the direction of the market and want to earn more profits in a shorter period of time. That’s why in today’s important article we will talk about this strategy. We will know what is BTST Trade, how does it work and how to use it to your advantage?

Ι What Is BTST Trade ?

To know what is BTST in share market First you have to know what is BTST trade? The meaning of BTST trading is reflected in its name. This strategy is mostly used in option and intraday trading. In this strategy, traders buy an option or a share today and sell it the next day. Their aim behind doing this is that when the market opens the gap up or gap down the next day, they can take advantage of it.

When traders feel from their analysis that the market is likely to open gap up or gap down the next day, they take trades in that direction today. And the next day when the market opens in their direction they get huge profits. In this market, we can take advantage of the upcoming fast ups and down.

BTST strategy is very much in demand for such traders, who have a good understanding of the market, and people who want to earn more profit in less time. Remember, being profitable also comes with risks. Therefore, it is important to pay attention to technical analysis and risk management while using it.

Ι How Does BTST Trade Work ?

Now we have learned what is BTST trade? BTST trade is mainly considered better for option trading and intraday trading. In this, whenever a trader buys an option or a share, he does not sell it on the same day and holds it for the next day. This is because he is confident based on his analysis that the market will open in his direction the next day. The real benefit of BTST trade is realized only when the market opens high gap up or gap down on the next day. However, if it opens in your direction rather than in your opposite direction, it can cause huge damage to you.

For example, if in your option trading you feel that the market may open 100-200 points above its current position, then you will buy the call side option and hold it for the whole night, and when In the morning the market opens in our direction and we get good profits.

Ι How To Take A BTST Trade ?

To trade in BTST, you have to follow some different steps, so that you can take entry and exit at the right time and you do not incur any loss. Some great steps have been given below:-

1. Select the right index or stock

To trade BTST you must first select a suitable index or stock. If you want to do BTST in a stock, then for that you will have to choose such a stock, which has more liquidity, so that you can sell it the next day when the market opens.

2. Confirm With The Technical Analysis

Now it is time to analyze the index or stock chosen by you. Remember, for BTST trading it is very important for you to know Technical Analysis. Because of which you thought that the market will open gap up or gap down the next day.

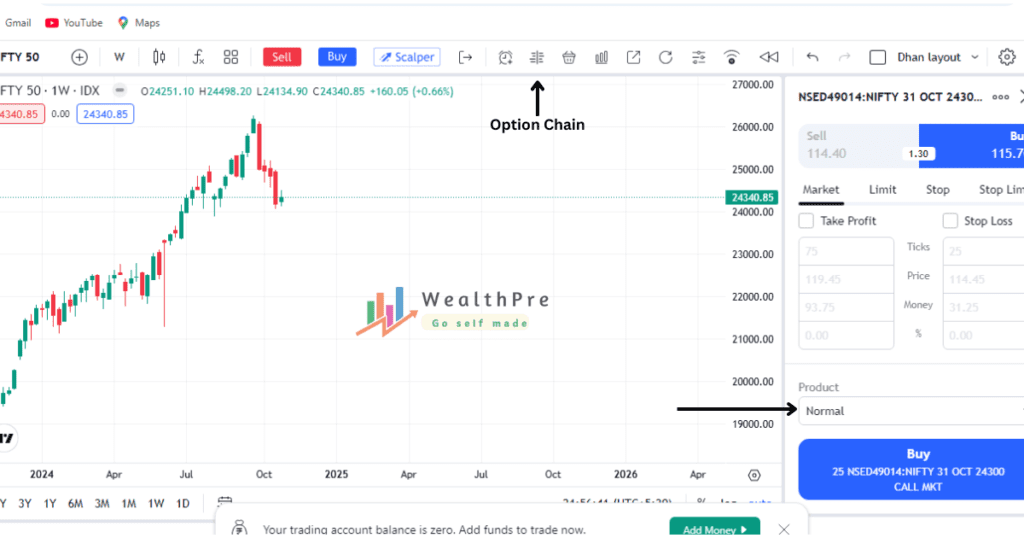

So, for example, let us show you a single trade in options trading on ‘dhan’ trading app.

First of all, to take trades you have to login to your demat account. Then we have to select our strike price by going to Nifty, or Bank Nifty, any index. For this you can use the option chain given by your broker. One thing to remember is that the right time to trade BTST is at the last time of the market. Now when we select the strike price, the order book will open in front of us.

After selecting the strike price, when the order book opens, first of all you have to enter your quantity, in the next product section you have to select ‘normal’. After that you have to place your order. Now your trade is completely ready for overnight position.

3. Use Stop loss

It is necessary to use stop loss in BTST trade. This is because if your analysis is wrong and the market does not open the gap up, it opens flat (flat means closing where it was yesterday, opening back to there again). So that it does not fall down after opening, it is very important to use stop loss.

4. Watch Trade On The Next Day

The next day is very important in BTST trade. You will have to track your trade when market open on the next day. next day When the market opens in your direction, you should quickly sell above and take your profit. And after market opening, if the market does not move in your direction, you can quickly exit your position, so that you will not incur any big loss.

Till now we have known what is BTST trade, how does it work and how is it done? Let us now know what is the right time to trade BTST ?

Ι Write Time For BTST Trade

Choosing the right trading time is very important in BTST trading strategy. There is a good time for the few big ups and downs in the market, at which time BTST trades are better. Here are some important tips to determine the appropriate time for BTST trading.

⇒ Time Before Just Market Close

The best time to buy options or stocks in stock trading is usually near market close, That means between 2:30 pm and 3:30 pm. At this time, the shape of the market is clear, which makes it easy to predict the next day’s price.

⇒ News And Event Timings

You will know how much the market is influenced by recent news and events. Like quarterly reports, any new rule etc. Trading BTST around such news and events is very profitable. If there is any good news related to a stock or index, there is a possibility of a rise in the price of that stock or index the next day. And if there is any disappointing news related to a stock or index, its price can fall the next day, so that a BTST trader can easily take profits.

By now we have known what is BTST trade , how it works, what is the right time for it etc. Now let’s try a strategy that is very similar to this, but it is its complete opposite. The name of our strategy is ‘STBT’. So let us know what is the difference between BTST and STBT?

Ι Difference Between BTST And STBT

The difference between BTST and STBT is shown in a chart below:-

| Aspect | BTST (Buy Today, Sell Tomorrow) | STBT (Sell Today, Buy Tomorrow) |

|---|---|---|

| Definition | Buying a stock today and selling it the next trading day. | Selling a stock today and buying it back the next trading day. |

| Purpose | To capitalize on anticipated short-term price rise. | To benefit from an expected short-term price decline. |

| Market Trend | Suitable in a bullish (rising) market condition. | Suitable in a bearish (falling) market condition. |

| Risk Level | Moderate – depends on next-day market performance. | High – especially if stock prices unexpectedly increase. |

| Delivery Requirement | No need to wait for stock delivery to sell it next day. | No stock borrowing is required; position is covered next day. |

| Best Trading Time | Near market close, when upward trend indicators are visible. | Near market close, when downward trend indicators are visible. |

| Key Indicators | RSI, MACD, moving averages for potential uptrend analysis. | Indicators showing overbought conditions or resistance levels. |

| Liquidity Requirement | Requires high liquidity stocks for easy sell-off the next day. | Also requires liquid stocks for smooth buy-back the following day. |

| Example Scenario | Buy a stock today expecting positive news and sell at profit tomorrow. | Sell a stock today anticipating poor results, then buy back cheaper. |

What is BTST Trade ?, what is BTST in Trading

In this article we have learned what is BTST trade, how it works, what is the best way to do it etc. Let us now know what are the advantages and disadvantages of BTST trading.

Ι Advantage

1. Quick Profit Opportunity

The biggest advantage of BTST is that it allows traders to make huge profits in a very short period of time. As we know that if we buy an option or stock today and its price goes up the next day, we can immediately sell it and make profit.

2. Opportunity for higher returns with less investment

The advantage of BTST is also that traders do not have to wait for long time. Therefore they do not need to worry about investing for long. You can make profit even with less capital, so for this you should have good opportunity to earn money.

3. Benefit From Market Volatility

In BTST trading, a trader can take great advantage of volatility, if he knows that the price of a share is likely to go up or down on the next day, he can buy today, sell tomorrow and make a huge profit.

4. Use Of Leverage

One advantage of BTST trading is that leverage can be used in it, so that you can buy high value assets even with less capital.

Ι Disadvantage

1. High Risk

Usually there is profit in BTST, but if your analysis is wrong then there can be equally big loss. If the asset you bought does not move according to your analysis the next day, you will suffer a loss as big as your profit. Therefore, stop loss should always be used while trading.

2. Extra Brokerage Fees

You may have to pay a little more in brokerage fees while trading BTST. These fees may different from broker to broker. If you have used leverage in BTST trading then you can also give interest on it.

3. Market Volatility

Market volatility brings benefits as well as losses to a trader. There is a lot of up and down movement in the assets traded in BTST, due to which there remains a risk of loss. If the asset you bought moves against you, it can cause you huge losses.

4. Need Of Technical Analysis

To do BTST trading it is very important for a trader to have knowledge of technical analysis. Without technical analysis it will not be possible to predict the next move of the market. And due to wrong prediction, loss can be incurred.

Ι Conclusion

BTST is a very simple trading strategy, it gives the opportunity to earn more profits in less time. It is mostly used by investors who can predict the price and movement of stocks. However, this can also be risky and one must have experience, knowledge of the charts and knowledge of the market to take the right decision. With proper management and risk control, BTST can be a good profit earning option.

In this article we have discussed all the aspects of BTST. We learned what is BTST trade, how does it work, what are its advantages and disadvantages etc. By adopting BTST in the right manner, you can make profits in the share market, but along with this, proper risk management and careful trading is also necessary.

We hope that the above information will help you a lot in learning about What Is BTST Trade. To get such valuable information related to trading and stock market, subscribe to our blog wealthpre.

Ι Frequently Asked Questions

what is BTST Trade ?

BTST means buy today sell tomorrow. In this strategy, any asset is bought before the market closes and held overnight, then the next morning when the market opens, it is sold at a profit or loss.

What is full form of BTST Trade ?

BTST full form is (Buy today sell tomorrow)

How to to choose index or stocks for BTST Trade?

For BTST trading, you should choose a stock or index which has liquidity, and based on your technical analysis its price is going to rise in the next day.

Are brokerage fees higher in BTST trading?

Yes, in BTST trading the fees are slightly higher than normal trading, and interest is also charged when leverage is used.